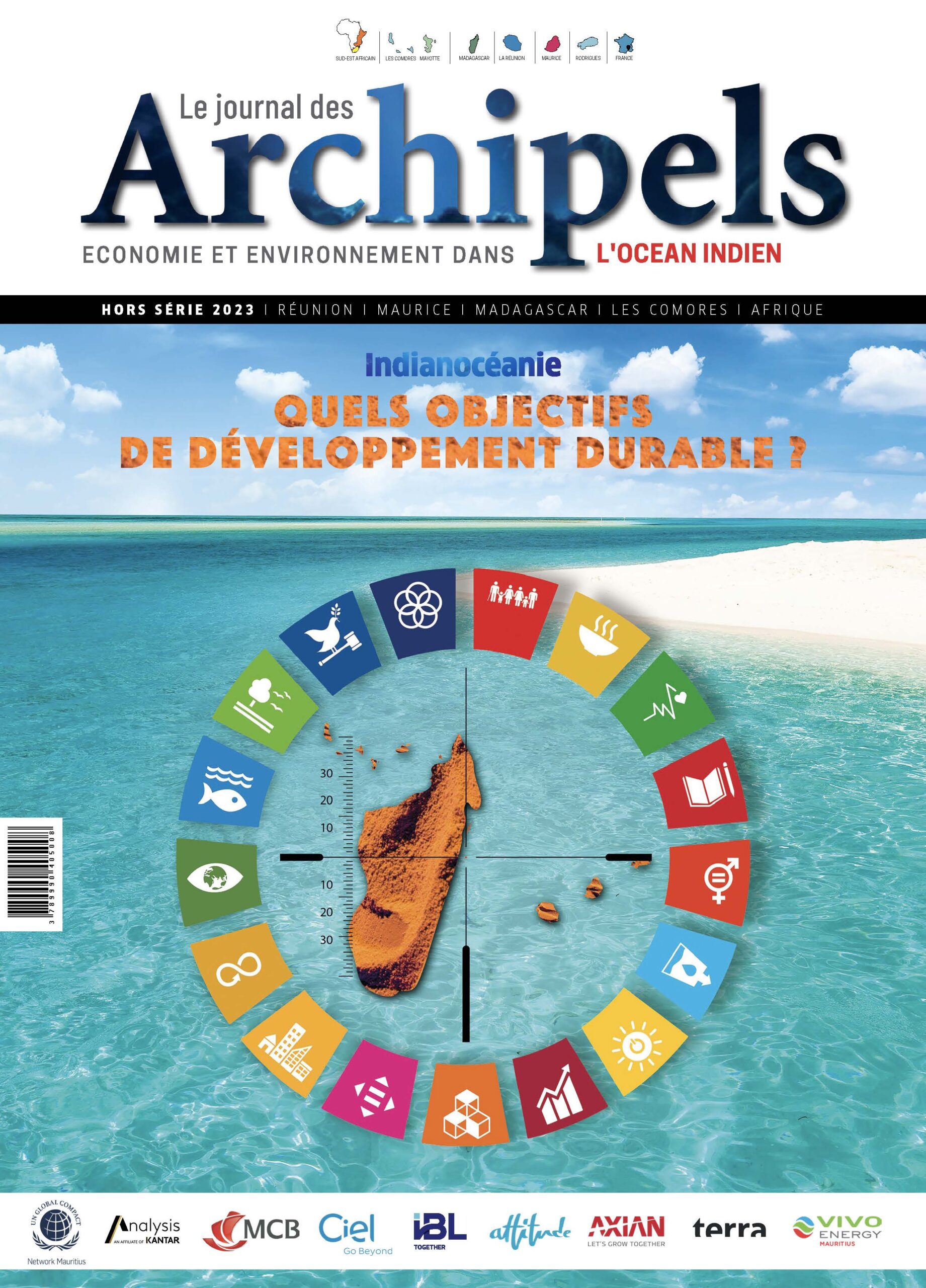

Sheila Ujoodha, General Director of MlOD (moderator) – Amédée Darga, Managing Director of StraConsult – Aruna Radhakeessoon, President of NCCG – Arnaud Lagesse, CEO of IBL Group.

(Jane Valls, Executive Director of GCC Board Directors Institute, also participated in Webinar from Dubai).

photo : DR

The Mauritius Institute Of Directors (MIOD) organized its first networking event on January 20.

The opportunity to take stock of the current context and to kick in the nest. Extracts.

The round table, organized on the theme “Corporate governance in the post COVID era” brought together more than a hundred political decision-makers, business leaders and journalists in Port-Louis.

While the observation that the economic, political and social crisis has affected Mauritius, like most countries in the world, the responses provided locally have been instructive. Starting with the intervention of the country’s leading entrepreneur Arnaud Lagesse : “the crisis was an opportunity to reset the clock and confirm what we already knew : that without flawless governance, a company cannot evolve. This remark can also be made to the Government, and I will close this parenthesis here… “

A parenthesis that the economist Amédée Darga (former president of the state body Enterprise Mauritius) did not hesitate to reopen in these terms : “if the Mauritian miracle could have happened it is thanks to good entrepreneurs supported by good institutions… Today we have the impression that the institutions are not as efficient and we only have to see who is present at this meeting today ”thus asking the question to the audience from where 5 shy hands of officials could be identified!

“In the private sector, management is a question of performance, while in the public sector it is a way to keep one’s job”

The economist, reassembled like a cuckoo reset to the timetable of the crisis, continued his diatribe in these terms : “if the regulators were really independent we would not have been blacklisted (by the EU about financial services Editor’s note)… Policies should not interfere with the proper regulation of established laws ”. Recalling in passing the rule of real life in a company : “Entrepreneurs are obliged to follow good governance for a question of survival while this principle is often unknown to public authorities… At the level of boards (offices or boards of directors Editor’s note) ), we can say that in the private sector, management is a question of performance while in the public it is a way to keep one’s job! “

Aruna Radhakeeson, speaking as president of the National Committee on Corporate Governance, specified in passing that “the NCCG is there to give the heads of public institutions all the tools aimed at good governance” indicating in the process the organisation of a workshop on governance next February.

A remark that the bubbling Amédée Darga was quick to comment on again : “what is important is that the directors are appointed by the boards of the institutions and not directly by the ministers” thus underlining what, in his eyes, is the main obstacle to good public governance. For Arnaud Lagesse : “each year we renew managerial positions in our various companies and if all CVs are accepted, only the criterion of competence for the position is decisive”

In the audience Mathieu Mandeng, CEO of Standard Chartered bank, made a relevant remark, quoting the French diplomat Talleyrand : “When I look at myself, I feel sorry. When I compare myself, I console myself ”, thus recalling the good place of Mauritius in the African ranking for which the small island could serve as a model by speaking of“ mutual benefits ”.

A note of optimism which then made it possible to conclude this first debate rich in lessons in the same tone : “with good governance, we can go very far. Let’s all work in this direction ”specified Arnaud Lagesse.

“It is time to apply these principles to today’s small and medium-sized enterprises which are a little forgotten…” Amédée Darga reminded us.

Jacques Rombi

* The National Corporate Governance Committee

Created as a result of the 2004 Financial Information Act (Act No. 45 of 2004) and entered into force on January 20, 2005. The main objective of the law was to create a strong and efficient central body responsible for overseeing information financial, accounting and auditing of companies, standards and practices and corporate governance in Mauritius. Article 63 of the law established the “National Committee on Corporate Governance” (NCCG) as the national coordinating body responsible for all matters relating to corporate governance.